This option provides a risk-free means of generating some

income from Art.

The process is as follows:

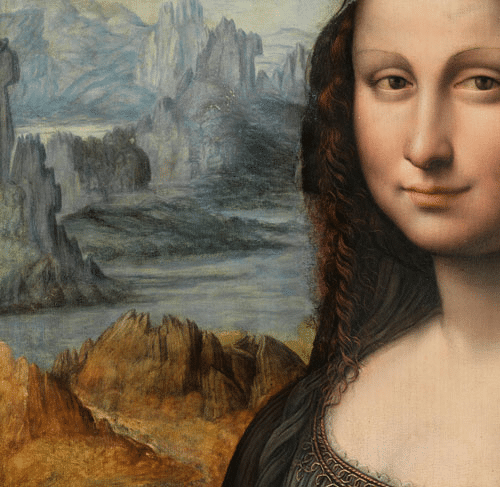

Why should we use NFTs to

protect Art and Luxury?

“Advanced technology not only allows governments to

detect authentic from false artifacts, but it also provides

new life to assets that would otherwise not be visible to us

all, being them in remote museums or even having

undergone massive destruction. Thanks to specific

research tools and devices, as well as digital, virtual and

augmented reality, today we can have a deeper

understanding of these objects and of the importance of

keeping on fighting against illicit trafficking of cultural

heritage.”

– Venice Science Gallery

This option provides a means of securitising and trading a

digital asset based on the underlying artwork. With this

option, the security represents an agreed percentage of the

physical artwork.

The process is as follows:

Create a Digital Twin of the underlying artwork

Perform a valuation of the digital asset

Create a token based on the digital asset

Issue a security, linked to the digital asset, on the

appropriate exchange

Market and Sell the security on primary and

secondary securities markets

Our program allows for the safe retention of the asset while leveraging its value in an income -producing program. The program combines the monetization and the revenue-generation into one initiative that does not risk the asset.

In order for an asset to qualify for monetization, it must meet all of the following criteria to certain minimums, which must be established and/or confirmed by internationally recognized third party experts.

– It must be marketable. There must be a sufficient market so that a realistic valuation can be established.

– It must be owned free and clear. The asset’s chain of title and provenance to the client must be well established. The asset cannot be hypothecated,

liened, mortgaged, or have any other liability against it.

– It must be secure. The item must be stored or otherwise held under an appropriate level of security and have sufficient, current insurance against

loss.